Compliance risk: The chance of non-compliance with relevant rules and restrictions, bringing about authorized and economical outcomes.

MT760 can be a information format commonly utilized to ship a guarantee or standby letter of credit score. Monetizing this instrument includes changing it into money or credit.

Don’t Enable the pressure of fulfilling a contractual obligation weigh on you. Book a consultation get in touch with to learn more regarding how we can assist provide you with the standby letter of warranty you need to move ahead confidently.

The use of SBLC helps to mitigate the hazards related to Intercontinental trade and supplies assurance to both the customer and the vendor. Having said that, in sure situation, the beneficiary may possibly have to have fast income or credit rating in lieu of awaiting the maturity with the SBLC. This is where SBLC monetization comes in.

A standby letter of assurance is actually a authorized agreement by a lender to meet a contractual obligation on behalf with the applicant, ought to they are unsuccessful to take action.

SBLC monetization presents Rewards including Increased credit history profile, strategic cash deployment for progress initiatives, and reworking SBLCs into Lively economical instruments.

Only on reviewing the copy with the SBLC & sender’s CIS, we are able to quotation the LTV% that we are able to give for that specific instrument.

SBLC monetization emerges as a sophisticated system that allows corporations to enhance their cash efficiency by converting these devices into liquid belongings.

Confirmed Letter of Credit score: Features a guarantee from a next lender Along with the issuing lender, furnishing supplemental security towards the beneficiary.

Misconceptions about “SBLC providers” lead to frequent frauds from the lender economical instrument sector. Providers really should be cautious of:

SBLC monetization is the entire process of converting an SBLC into usable money or credit history traces. It in essence will allow the holder of the SBLC to leverage the document’s value to get funding for various functions, which includes investments, challenge funding, or Operating capital.

This really is venture funding can be especially beneficial for little and medium-sized enterprises (SMEs) that may not have use of conventional funding possibilities.

If you’re taking into consideration monetizing an SBLC, there are various Rewards you need to know about. These Rewards will let you understand why monetizing an SBLC may be a sblc provider wonderful monetary conclusion for your business. Here are several of The true secret Added benefits:

A letter of credit history, often called an SBLC, is another variety of credible lender instrument that is often Employed in Worldwide trade.

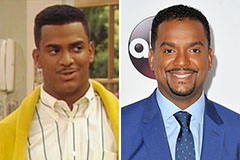

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Kirk Cameron Then & Now!

Kirk Cameron Then & Now! Christina Ricci Then & Now!

Christina Ricci Then & Now! Joshua Jackson Then & Now!

Joshua Jackson Then & Now! Michael C. Maronna Then & Now!

Michael C. Maronna Then & Now!